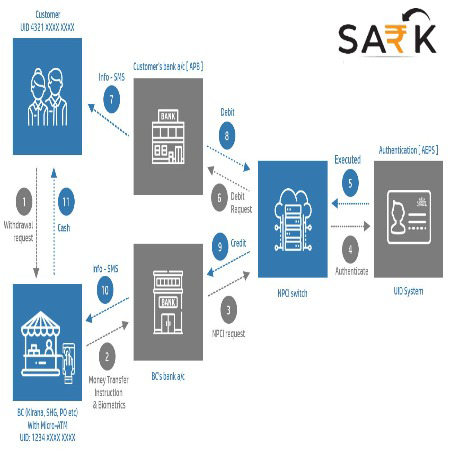

SARK AEPS service enables our customers for hassle-free and secure cash to withdraw, balance enquiry and a mini statement from their AADHAR linked bank accounts.

Aadhaar enabled Payment System (AEPS) is a secured payment method provided by the National Payments Corporation of India (NPCI) that allows aadhaar linked bank account holders to avail basic banking services such as balance inquiry & cash withdrawal. Customers simply need to tell SARK Retailer their 12-digit aadhaar number and aadhaar linked Bank name. Fingerprint authorization is done using a biometric device to avail the service.

Aadhar enabled payment system is a bank-led model which allows online interoperable financial transaction at PoS (Point of Sale / Micro ATM) through the Business Correspondent (BC)/Bank Mitra of any bank using the AADHAR authentication.

The process of using AEPS is quite simple. Follow these simple steps :

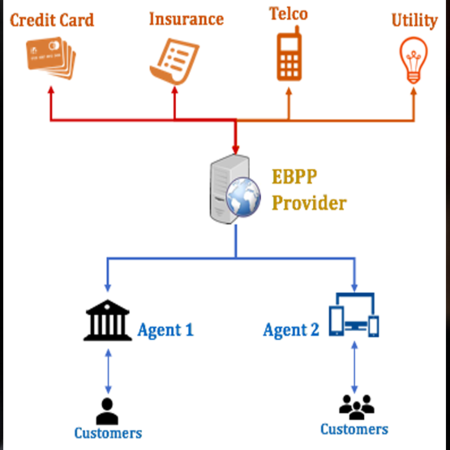

Pay electricity bills, postpaid bills, gas bills, water bill, etc. in one click from SARK portal and make your customers happy and get an attractive commission.

Bharat Bill Payment System (BBPS) is RBI essential system that provides an integrated, interoperable invoice payment service to customers from all regions, with transaction certainty, reliability, and security. It provides customers with bill payment services through an agent network or online, enables multiple payment modes, and provides instant confirmation via BBPS web, BBPS app, SMS or receipt. We are promoting a cashless society by shifting cash bill payments to electronic channels. Currently, you can pay bills for utilities (gas, electricity, water, DTH) and telecommunications.

Online Utility Bill Payment Business is a profitable business for small entrepreneurs and shop owners to add extra income. As India is moving towards digital transactions so making online payments is profitable business as water bill, electricity bill, gas bill, postpaid bill, internet bill etc. become online. SARK utility bill payment franchise is very easy to own as you just need to have your own shop and Smartphone or laptop.

Start your mobile recharge, DTH business now with SARK and earn the highest commission on each recharge. with 100% successful transaction SARK portal is simple & easy processing.

One can become our partner and add extra to your income. You can start a mobile recharge shop very easily and from your shop in your locality. Our company will provide you mobile recharge portal software for your business. You can recharge telecoms like Idea, Vodafone, Jio, Airtel etc. We are the best multi recharge app for your business and our success ratio is more than 99%. The mobile recharge retailer commission is very attractive in low investment.

You can complete the mobile, data card or DTH online recharge in just two steps, and then you can enjoy uninterrupted service.

>

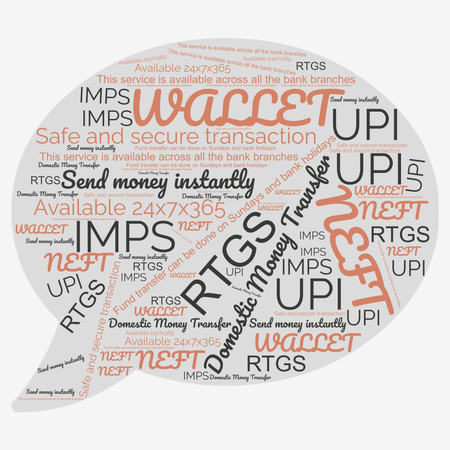

Fund transfers will now be made easy with Cash to Account. Carry in cash and walk-in to any SARK merchant establishments, fill in few details and have the money transferred to your loved ones, anywhere in the country.

The various options through which users can make money transfer online are listed below-

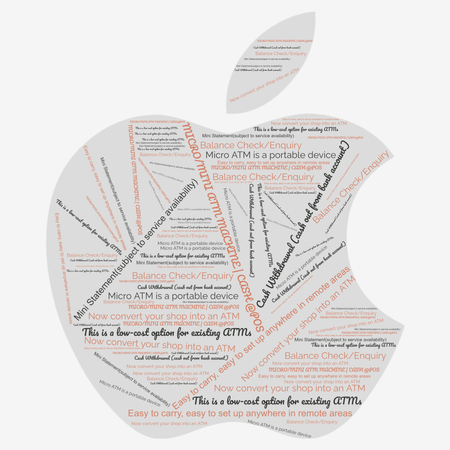

SARK has taken a step forward in the field of Financial Inclusion with an introduction of ‘Micro/Mini ATM Service’ to enable our agents to modify their shops into a digital banking system.

SARK vision is to build an extensive public banking infrastructure that not only provides quality banking services, but also is available to ordinary citizens in urban and rural India. Supplementary Branch Outreach is a Micro/Mini ATM network that provides convenient banking services to citizens. All in all, this is one of SARK missions to bridge the gap between the availability and accessibility of ordinary citizens providing simple banking services. As India’s first interoperable operating system, it is a banking innovation that can serve any bank customer though our portable device with a debit card interface. The MicroATM Machine is operated by an agent that will include a card reader for all cash withdrawal and balance inquiry transactions from all bank debit cards.